Registration Form

Mergers and Acquisitions have increasingly become an essential part of the corporate strategy of many companies. M&A, of late, has redefined the way we look at business and conduct business. It has reshaped the business landscape to the extent that every corporate strategy is intricately interwoven with certain M&A activity. This clearly signifies the importance of the knowledge pertaining to strategizing and leveraging the Mergers and Acquisitions field in the corporate.

Merger & acquisition (M&A) activity involving India hit an all-time high at $130.3 billion in the first half of 2022, more than double that in the first half of 2021, data with Refinitiv, an LSEG business, showed. This is the highest M&A value for a semiannual period since records began (for Refinitiv) in 1980.

“Significant growth opportunities in the Indian market and domestic consolidation bolstered M&A activity, led by the $60.4-billion merger between HDFC Bank and Housing Development Finance Corporation, the largest-ever Indian deal on record,” said Elaine Tan, Senior Analyst at Refinitiv.

EBC Learning’s Live Online Course on Mergers and Acquisitions (M&A) Practice (Three-Week Intensive Course):

EBC Learning is India’s leading provider of courses on Law. EBC Learning’s live courses and pre-recorded courses equip students and lawyers with 21st-century skills to help them ace their careers and gain practical skills and acumen.

A complete M&A transaction requires planning, strategy and foresight of the several players involved. This three-week course by EBC Learning will give you the opportunity to understand the entire deal process from start to finish, i.e., from the pre-deal stage to post-deal integration and disputes. The objective of this course is to bring about an in-depth understanding of M&A transactions and is very useful to aspirants who wish to become qualified experts.

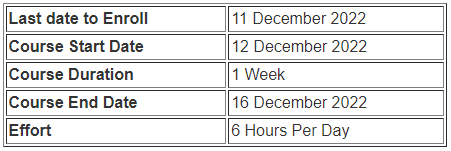

Important Details

About this Course

The most important assets that any M&A practitioner can possess are good business acumen, an understanding of what drives the businesses and industries in question, and the negotiation skills required to close the deal and the application of the practical laws.

This intense course on M&A contains the following:

- Merger Control

- Hostile Takeovers

- Structuring an M&A Transaction

- M&A Deal Agreements and Negotiation

- Tax Implications of Structuring

- Financing Acquisition

- M&A Disputes and Litigation

- Commercial Due Diligence

- M&A Due Diligence Process

This course covers various aspects of M&A transactions, including how to structure an M&A transaction, understand the emerging trends in M&A structure, appreciate the tax implications of structuring an M&A deal, how to conduct a commercial and legal Due-Diligence, and practical application of applicable laws. As part of the course, you will get to access the following:

- High-quality video materials

- 15 hours of dedicated live learning

- Recordings of the live sessions

- Curated materials and assignments divided into 28 Chapters

- Books on M&A at EBC Reader

- Full text of cases from SCC Online

- EBC Learning Certificate

The classes will be conducted on Saturdays.

Table Of Contents:

1. Transacting Mergers and Acquisitions

- 1.1 Welcome and scope

- 1.2 Understanding the team and a lawyer’s role

- 1.3 Becoming an M&A lawyer

- 1.4 Supplement

2. Understanding Corporate Transactions

- 2.1 Mergers

- 2.2 Amalgamations or scheme of arrangement

- 2.3 Acquisition

- 2.4 Stock Acquisition

- 2.5 Asset sale or slump sale

- 2.6 Joint ventures

3. Undertaking M&A Transactions

- 3.1 Identifying the motives and triggers for an M&A transaction

- 3.2 Identifying the other party and preliminary evaluation

- 3.3 Kick-off meeting

- 3.4 Due diligence

- 3.5 Negotiations

- 3.6 Signing the agreement and other formalities

- 3.7 Structuring the transaction

- 3.8 Structuring considerations of the parties

- 3.9 Stock versus asset-purchase considerations

4. Leveraged Buyouts and Management Buyouts

- 4.1 Leveraged buyouts

- 4.2 Management buyouts

- 4.3 Leveraged and management buyout process

5. M&A Transaction: Legal Requirements and Issues

- 5.1 Applicable laws

- 5.2 M&A and Companies Act: Provisions on share transferability

- 5.3 Preferential allotment

- 5.4 Why do target companies issue new shares in M&A?

- 5.5 Issuance of preference shares: Points to remember

- 5.6 SEBI Takeover Code

- 5.7 SEBI Listing Regulations, 2015

- 5.8 M&A and the Competition Act

- 5.9 Foreign Exchange Management Act, 1999 (FEMA)

- 5.10 Income Tax Act and indirect taxation

- 5.11 Stamp duty

6. Pre-deal Agreements and Documents

- 6.1 Introducing pre-deal agreements

7. Pre-deal Agreements – Confidentiality Agreements

- 7.1 Confidentiality agreement

- 7.2 Enforcement of confidentiality agreement

8. Pre-deal Agreements – Standstill, Exclusivity and No-shop Provisions

- 8.1 Standstill agreements

- 8.2 Exclusivity agreements

- 8.3 No-Shop provisions

- 8.4 Fiduciary Out

- 8.5 Inter-play between exclusivity, no-shop and fiduciary-outs agreements

9. Pre-deal Agreements – Letters of Intent, MOUs and Term Sheets

- 9.1 Letters of intent or memorandum of understanding or term sheets

10. Acquisition Agreement

- 10.1 Acquisition agreements: Structure and recitals

11. Acquisition Agreement – Purchase Price Provisions

- 11.1 Form of consideration

- 11.2 Collars

- 11.3 Fixed and contingent consideration

- 11.4 Earnouts

- 11.5 Financing risk & commitment letters

12. Acquisition Agreement – Representations & Warranties

- 12.1 Form of representations and warranties

- 12.2 Functions of the representations

- 12.3 Scope of seller’s or target’s representations

- 12.4 The buyer’s representations and warranties

- 12.5 Qualifications to the representations

- 12.6 Disclosure schedules

13. Acquisition Agreement – Covenants

- 13.1 Introduction

- 13.2 Operating covenants and “Get the Deal Done” covenant

- 13.3 Affirmative covenants

- 13.4 Other post-closing covenants

14. Acquisition Agreement – Closing Conditions

- 14.1 Closing conditions

15. Acquisition agreement – Termination

- 15.1 Termination rights

- 15.2 Breakup fees and reverse termination fees

- 15.3 Material adverse effect

- 15.4 Material adverse effects carve-outs

16. Acquisition Agreement – Remedies

- 16.1 Remedies – Termination

- 16.2 Remedies – Basic indemnity

- 16.3 Remedies – Special indemnity

- 16.4 Escrow agreement

17. Ancillary Agreements

- 17.1 Ancillary agreements

- 17.2 Side-letters

- 17.3 Assignment of IP

- 17.4 Employment agreements

18. Negotiating M&A deals

- 18.1 Introducing negotiations

- 18.2 Prepare, and prepare some more

- 18.3 Understanding leverage

- 18.4 Control the agenda/writing

- 18.5 Have a written “heat map”

- 18.6 Think through your strategy

- 18.7 Ethics and listening skills

19. Conclusion

- 19.1 Next steps

LIVE CLASS: Merger Control

LIVE CLASS: Hostile Takeovers

LIVE CLASS: Tax Implications of structuring

LIVE CLASS: Financing Acquisition

LIVE CLASS: Structuring an M&A Transaction: Start-ups & Emerging M&A Structures

LIVE CLASS: M&A Deal Agreements and Negotiation

LIVE CLASS: M&A Disputes and Litigation

20. M&A Due Diligence Process: Introduction

- 20.1 Welcome

- 20.2 Supplements

21. M&A Due Diligence Process: Defining Due Diligence

- 21.1 Introduction

- 21.2 Meaning of due and diligence

- 21.3 Dictionary meaning of due diligence put together

- 21.4 What due diligence means in the modern-day context?

- Exercises I

22. M&A Due Diligence: Why do Due Diligence?

- 22.1 Introduction

- 22.2 Validation of legitimacy and authenticity

- 22.3 Sound commercial call or informed decision making

- 22.4 Ascertaining faults and liabilities

- 22.5 Arriving at the rightful valuation

- 22.6 Defining conditions Precedents and warranties

- 22.7 Identifying risks

- Exercises I

23. M&A Due Diligence: Who needs due diligence?

- 23.1 Introduction

- 23.2 Contracting or contractual parties

- 23.3 Prospective business partners

- 23.4 Investor parties

- Exercises I

24. M&A Due Diligence: What does due diligence find?

- 24.1 Introduction

- 24.2 The organisational & business structure

- 24.3 The financial aspect

- 24.4 The assets base

- 24.4.1 Assets Base – Intangible assets

- 24.4.2 Assets Base – Due diligence of intellectual property rights

- Exercises I

- 24.6 Human resource

- 24.7 The Target’s business strategy

- 24.8 Any legal barriers, impediments or issues

- 24.9 Conclusion

- Exercises II

25. M&A Due Diligence: Practicing due diligence

- 25.1 Introduction

- Exercise I

26. M&A Due Diligence: Client interview

- 26.1 Introducing client interview

- 26.2 Specific information needs

- 26.3 Scope of review

- 26.4 Constraints in the process

- Exercises I

27. M&A Due Diligence: Effecting due diligence on ground

- 27.1 Introduction

- 27.2 Formal Information Gathering (FIG) – Introduction

- 27.3 FIG – Target disclosures

- 27.4 FIG – Public records

- 27.5 FIG – Independent Investigative Intelligence (Triple Eye)

- Exercises I

28. M&A Due Diligence: Due diligence review & result reporting

- 28.1 Introduction

- 28.2 Due diligence review

- 28.3 Due diligence report

- Exercises I

LIVE CLASS: M&A Due Diligence Process -I

LIVE CLASS: M&A Due Diligence Process – II

LIVE CLASS: Commercial Due Diligence & Overview: Looking for a Deal, the Deal Process and Valuation